The Buzz on How To Get Copy Of Bankruptcy Discharge Papers

Not known Details About Chapter 13 Discharge Papers

Table of ContentsThe Only Guide to How To Obtain Bankruptcy Discharge LetterThe Greatest Guide To Copy Of Chapter 7 Discharge PapersHow Do You Get A Copy Of Your Bankruptcy Discharge Papers for BeginnersAll About How To Get Copy Of Chapter 13 Discharge PapersHow How To Obtain Bankruptcy Discharge Letter can Save You Time, Stress, and Money.

Attorney's are not called for to maintain bankruptcy filings."Free Bankruptcy Documents"A. All Firm and Company Record, might be purchased by calling the U.S.A. Bankruptcy records personal bankruptcy to make use of kept indefinitely maintained 2015. Laws have currently changed to maintain personal bankruptcy data for just 20 years - https://diecast.org/community/profile/b4nkrvptcydcp/.

If you submitted insolvency in 2004 or prior, your documents are limited, as well as might not be offered to buy electronically. Call (800) 988-2448 to check the schedule prior to buying your documents, if this applies to you.

What Does Chapter 13 Discharge Papers Mean?

United state Records cost's to aid in the retrieval procedure of obtaining personal bankruptcy paperwork from NARA, relies on the moment involved as well as price entailed for united state Records, plus NARA's costs The Docket is a register of basic info throughout the bankruptcy. Such as condition, situation number, filing and also discharges days, Attorney & Trustee details.

If you're late paying the tax obligation, maintain the return two years from the day you paid or three from when you filed (whichever is later on). When it concerns invoices, if there's a warranty, maintain the invoice until the warranty runs out. Or else, for anything you may require to repossess, just maintain the receipt till the return duration is up.

Despite the fact that your bankruptcy application, documents, and discharge seem like financial records that might fall under the very same timeline as your tax docs, they are NOT (how to get copy of bankruptcy discharge papers). They are far a lot more vital and also should be kept indefinitely. Lenders may return and also attempt to collect on a debt that was component of the bankruptcy.

Copy Of Bankruptcy Discharge Can Be Fun For Anyone

Creditors sell off poor financial debt in pieces of thousands (or hundreds of thousands) of accounts. Uncollectable bill buyers are typically aggressive and unscrupulous, and also having your personal bankruptcy papers on-hand can be the fastest way to close them down and keep old things from standing out back up on your credit history report.

Getting copies of your bankruptcy files from your lawyer can take time, specifically if your situation is older and the duplicates are archived off-site. Obtaining insolvency documents from the Federal courts can be pricey and also taxing.

Get a box or large envelope and also placed them all within. Put them in a risk-free place, as well like where you maintain your will certainly and also various other important financial records and also simply leave them there.

Facts About Copy Of Chapter 7 Discharge Papers Revealed

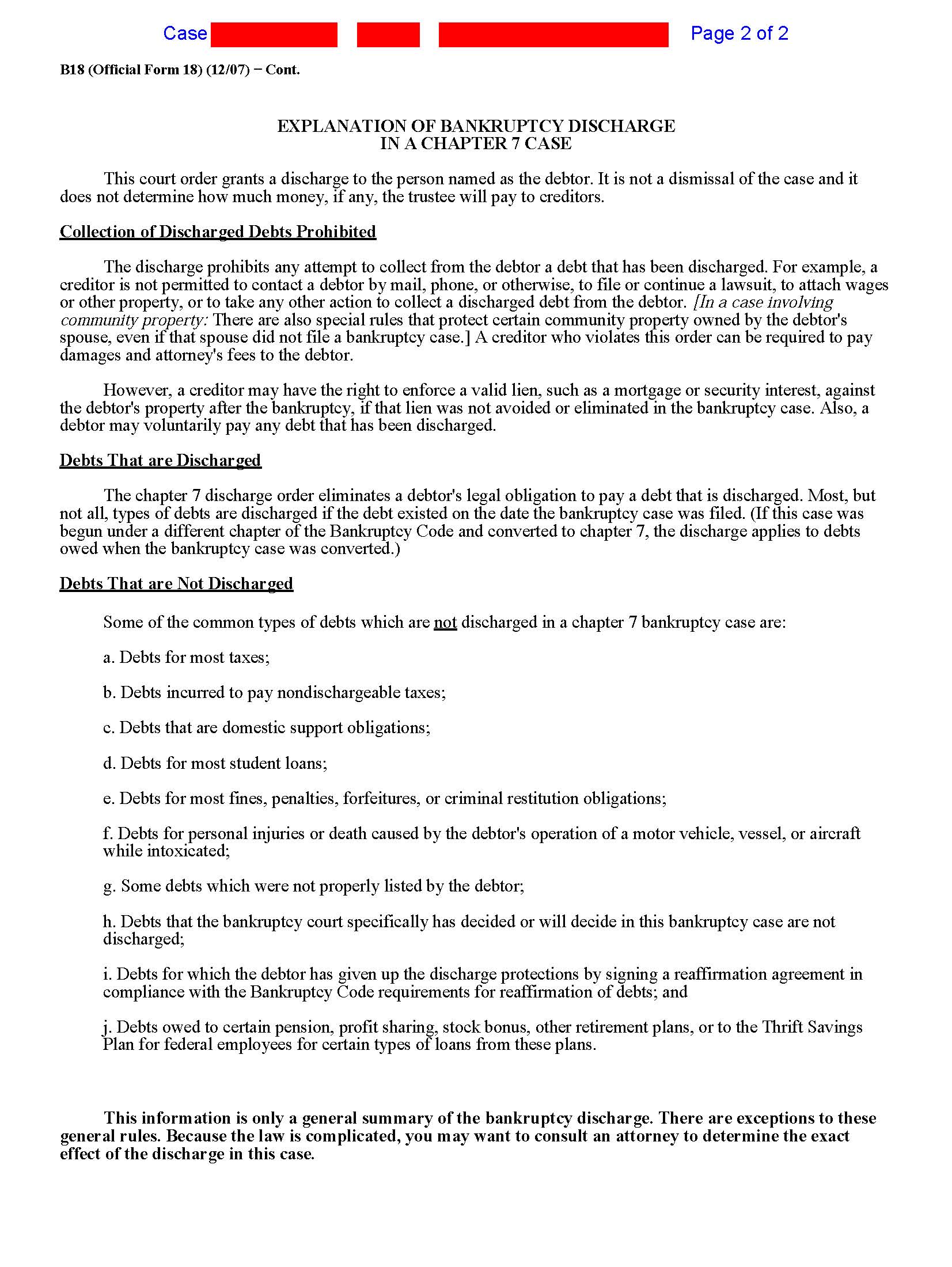

A discharged financial debt essentially goes away. Financial debts that are most likely to be released in a bankruptcy case consist of credit card debts, medical costs, some lawsuit judgments, individual loans, responsibilities under a lease or other agreement, and other unsafe financial debts.

You can't merely ask the personal bankruptcy court to discharge your financial obligations since you do not want to pay them. You should complete all of the needs for your insolvency instance to obtain a discharge.

Personal bankruptcy Trustee, as well as the trustee's attorney. The trustee personally manages your bankruptcy instance. This order consists of notice that financial institutions must take no more actions to collect on the debts, or they'll encounter punishment for contempt. Keep a copy of your order of discharge in addition to all your other personal bankruptcy documentation.

Everything about Bankruptcy Discharge Paperwork

You can file a movement with the bankruptcy court to have your situation resumed if any type of creditor tries to accumulate a discharged financial debt from you. The creditor can be fined if the court determines that it broke the discharge injunction. You can try merely sending a copy of your order of discharge to stop any collection task, and after that speak with a personal bankruptcy attorney concerning taking legal activity if that doesn't work.

The trustee will liquidate your nonexempt assets and also split the profits amongst your financial institutions in a Phase 7 personal bankruptcy. Any type of debt that remains will certainly be released or eliminated. You'll enter into a layaway plan over 3 to five years that settles all or a lot of your debts if you declare Chapter 13 security.